指数关注

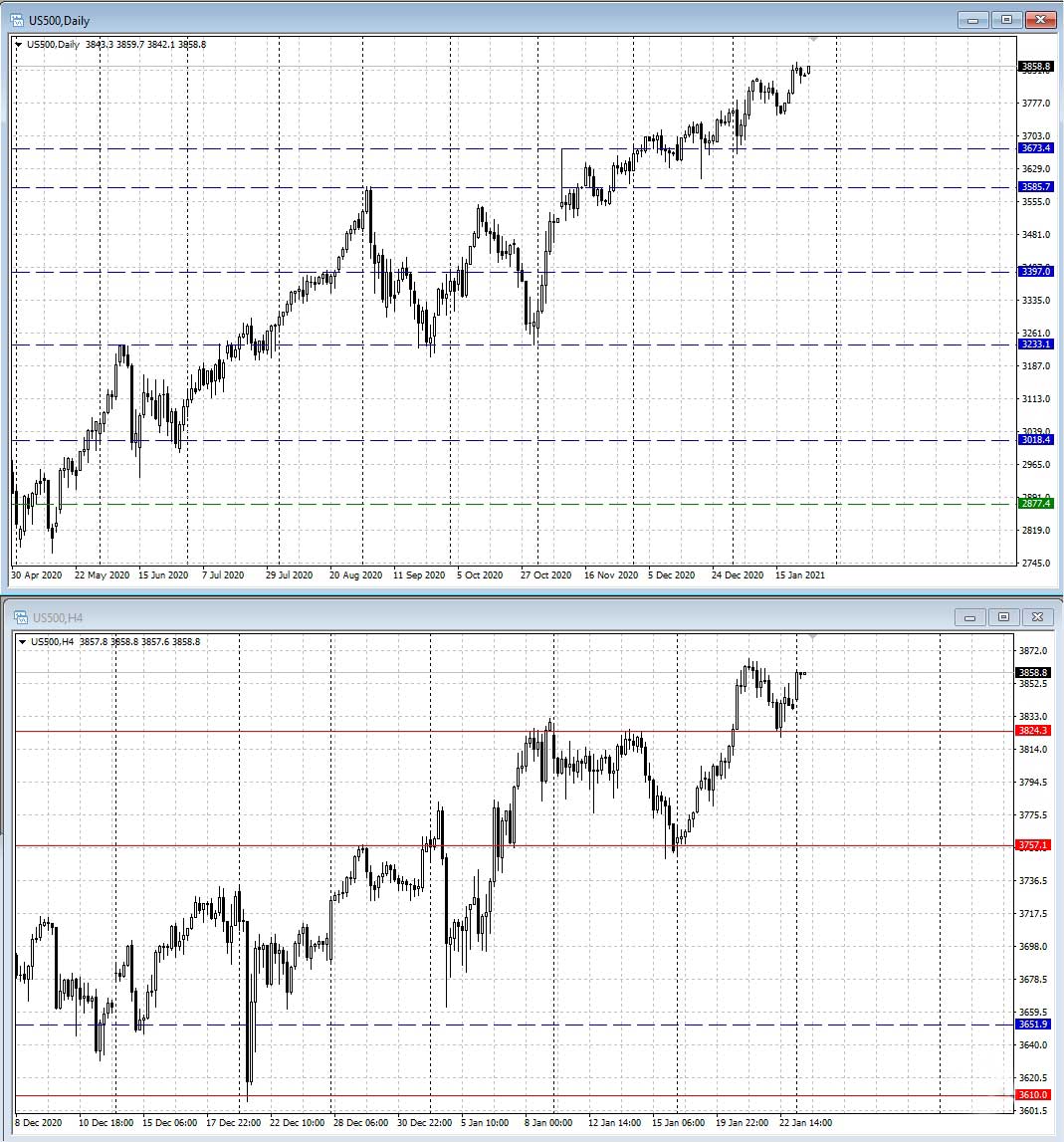

从技术上讲,标准普尔500指数高于关键的3824点(图1)。

(图1)

而纳斯达克100指数还将继续更新,保持在13320左右(图2)。

(图2)

Technically, the S&P-500 is above the key local 3824 (Fig. 1).

It also continues to update new historical values and the technological index, technically a new growth impulse after a beautiful retention of local support at 13320 (Fig. 2).

重点货币对关注

美元兑日元在103.7的区域内找到了一定的平衡,而104.6的价格仍然是长期趋势的关键(图3)。

(图3)

欧元兑美元的脆弱点仍在全球流动性区域附近,局部为1.216(图4)。

(图4)

Here we see that the dollar against the yen finds a certain balance in the area of 103.7. But the fact that sales are trying to buy out a very important moment, the price of 104.6 remains the key for long-term trends (Fig. 3).

In the meantime, the fragile point remains globally near the liquidity zone, and locally with the support of 1.216 (Fig. 4).

商品关注

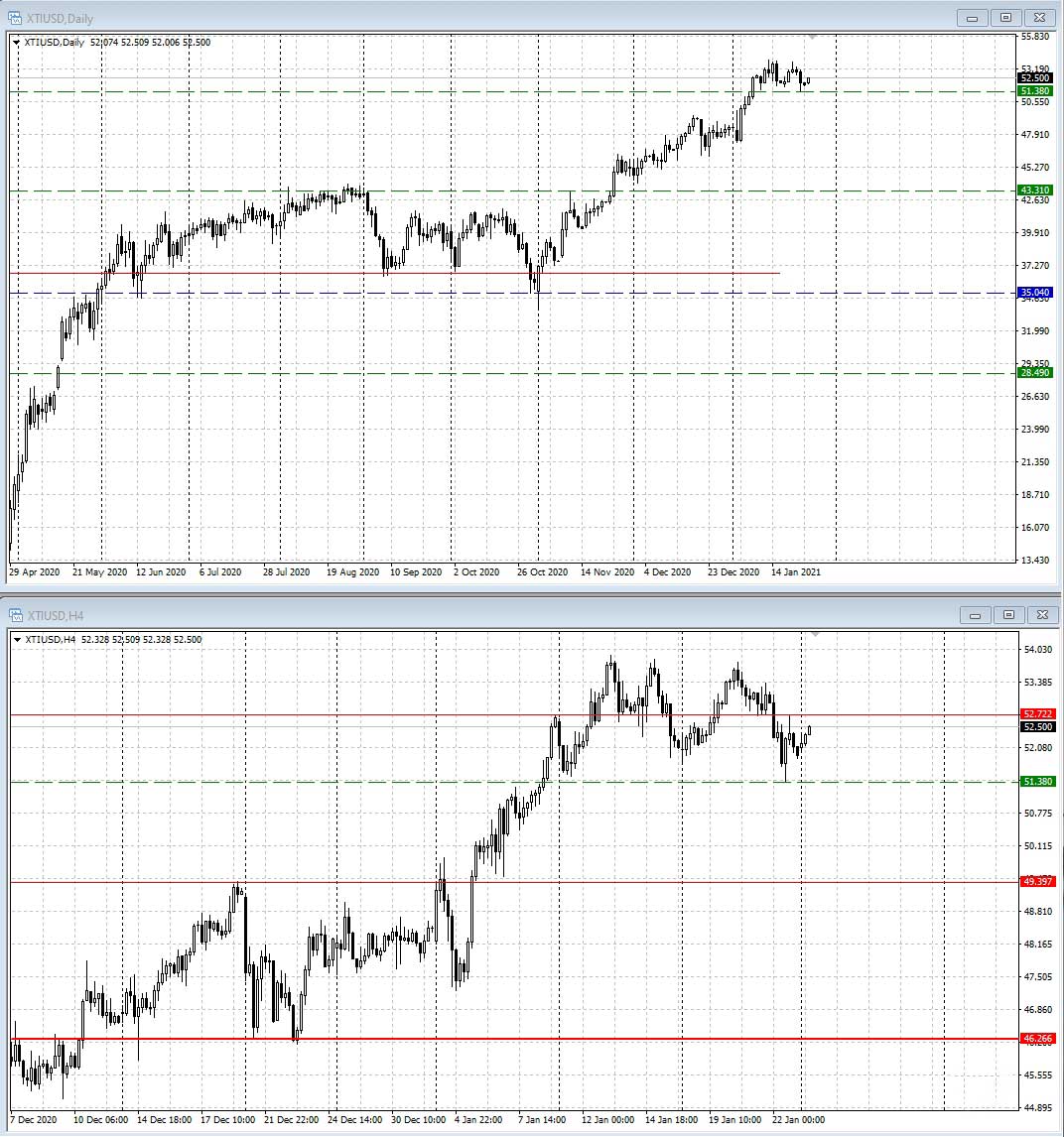

原油上涨超过52.7的这一关口之后,可能会出现较为不利的局面(图5)。

(图5)

An extremely unfavorable picture was already developing for buyers after the breakdown of 52.7 and the repeated unsuccessful rise above this mark (Fig. 5).

其他数据关注

本周三是关键的一天。上周日本、加拿大、欧盟对利率的决定没有改变,现在轮到美国了。剩下0.25个基点,刺激计划仍在继续,但和往常一样,所有的注意力都在美联储的新闻发布会之后。

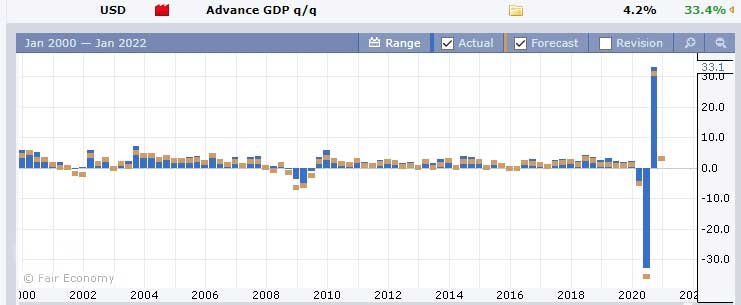

周四将公布的季度GDP数据预计为4.2%。而之前至少通过采购经理人指数(PMI)数据进行了解读,只有强烈的差异才能引起市场对这一指标的情绪反应(图6)。

(图6)

本周末,美国还将公布个人收入和支出数据,以及通胀预期,这些数据将给他们的低值提供一个游荡乐观情绪的机会(图7)。

(图7)

The key day this week is Wednesday. Last week we saw unchanged decisions on interest rates from Japan, Canada, the EU, and now the turn comes to the United States. Yes, it is hardly worth waiting for something unexpected here. 0.25 basis points will be left, the stimulus program continues, but as usual, all the attention is behind the Fed's press conference.

On Thursday, will be the publication of quarterly GDP figures are expected to be at 4.2%. But, frankly, this data is already included in the price and was previously read through at least the ISM PMI numbers. Only some strong discrepancy can cause an emotional reaction in the market to this indicator (Fig. 6).

At the end of the week, the US is also to publish data on personal income and spending, as well as inflationary expectations, which so far give their low values an opportunity to roam optimism. The first news of fear will arrive with an increase in the value above 3% (Fig. 7).